Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales.

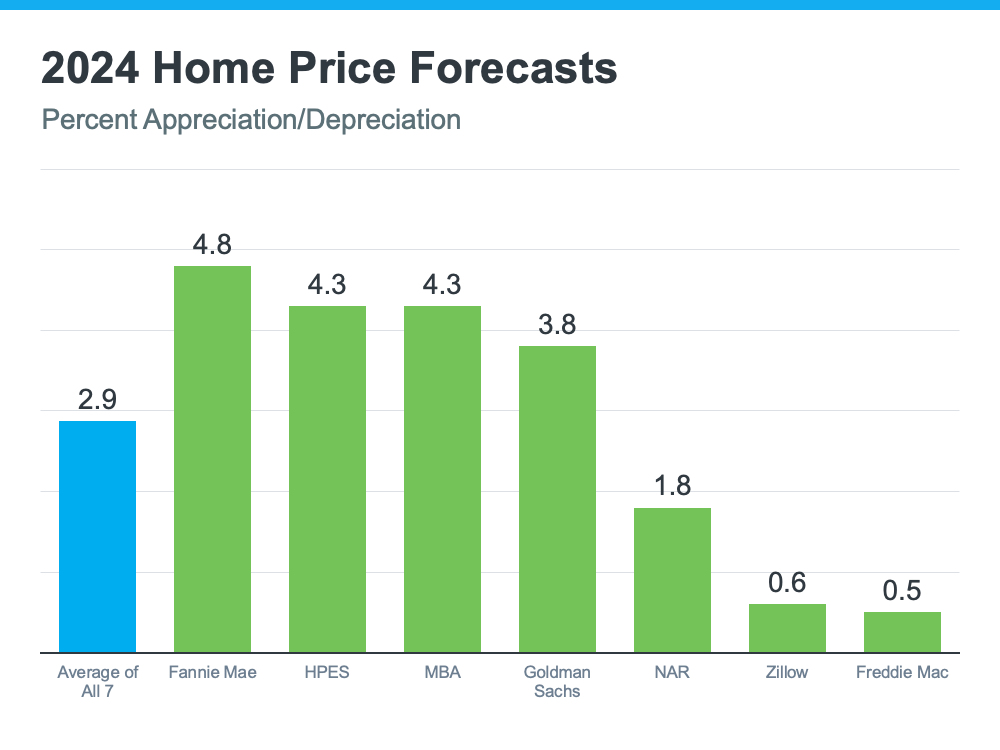

Home Prices Are Expected To Climb Moderately

Home prices are forecasted to rise at a more normal pace. The graph below shows the latest forecasts from seven of the most trusted sources in the industry:

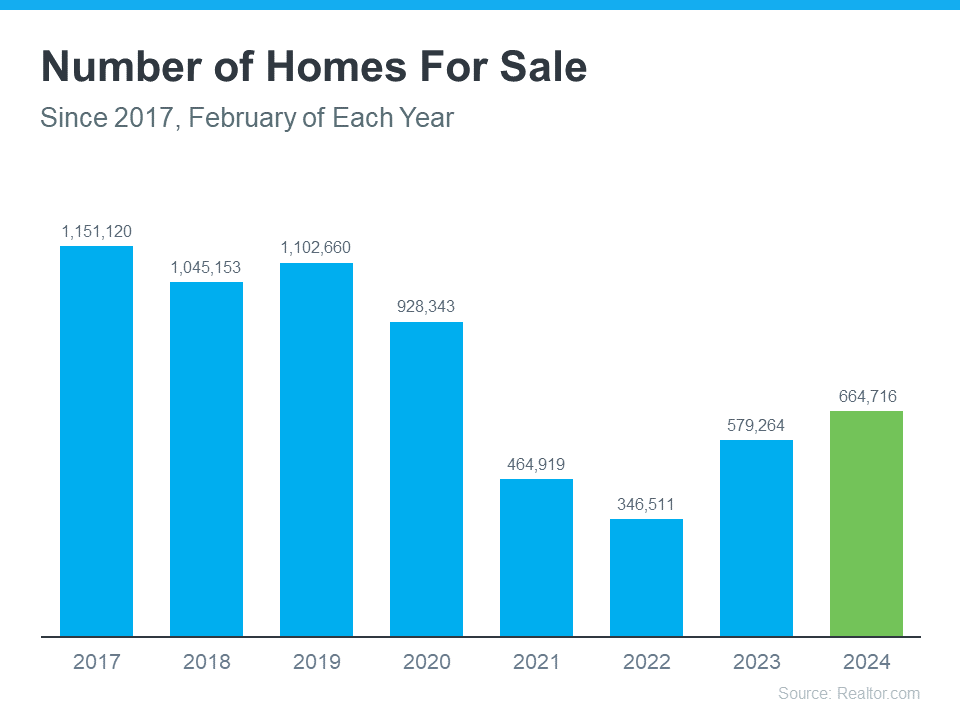

The reason for continued appreciation? The supply of homes for sale. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), explains:

“One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have housing inventory.”

While inventory is up compared to the last couple of years, it’s still low overall. And because there still aren’t enough homes to go around, that’ll keep upward pressure on prices.

If you’re thinking of buying, the good news is you won’t have to deal with prices skyrocketing like they did during the pandemic. Just remember, prices aren’t expected to drop. They’ll continue climbing, just at a slower pace.

So, getting into the market sooner rather than later could still save you money in the long run. Plus, you can feel confident experts say your home will grow in value after you buy it.

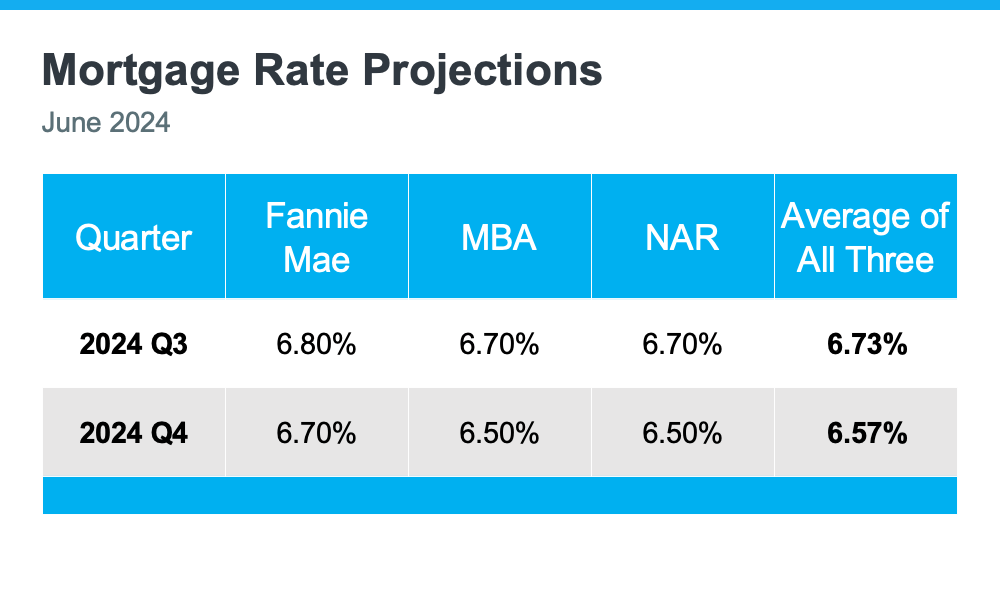

Mortgage Rates Are Forecast To Come Down Slightly

One of the best pieces of news for both buyers and sellers is that mortgage rates are expected to come down a bit, according to Fannie Mae, the Mortgage Bankers Association (MBA), and NAR (see chart below):

When you buy, even a small drop in mortgage rates can make a big difference in your monthly payments. For sellers, lower rates will bring more buyers back into the market, which can help you sell faster and potentially at a higher price. Plus, it may help you get off the fence, if you’ve been hesitant to sell due to today’s rates.

When you buy, even a small drop in mortgage rates can make a big difference in your monthly payments. For sellers, lower rates will bring more buyers back into the market, which can help you sell faster and potentially at a higher price. Plus, it may help you get off the fence, if you’ve been hesitant to sell due to today’s rates.

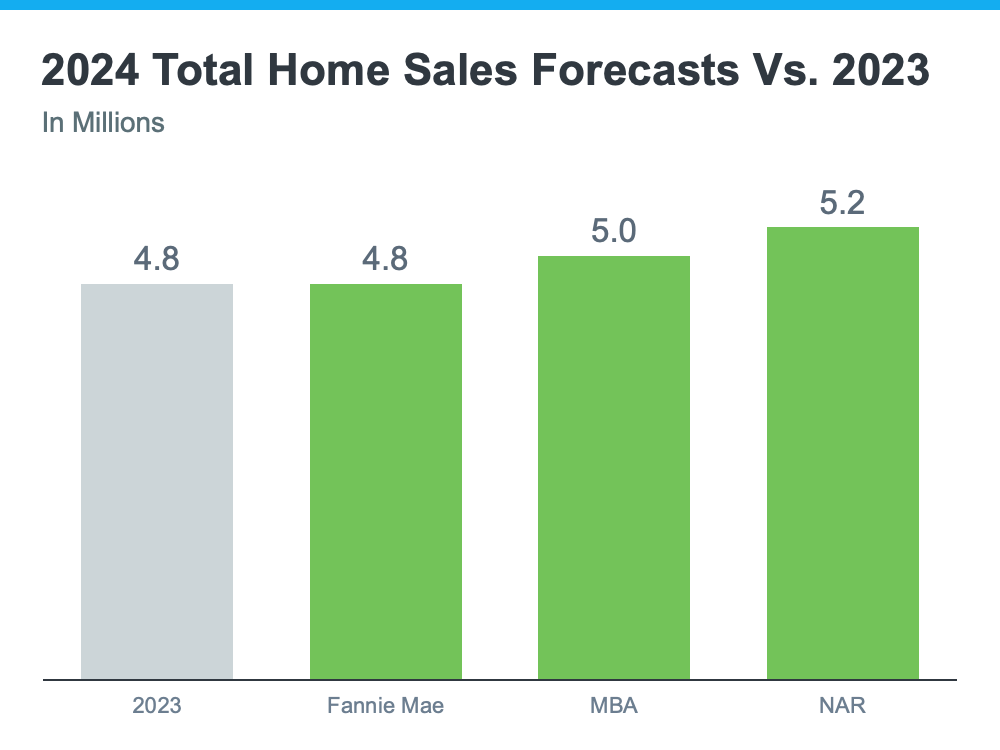

Home Sales Are Projected To Hold Steady

For 2024, the number of home sales will be about the same as last year and may even rise slightly. The graph below compares the 2024 home sales forecasts from Fannie Mae, MBA, and NAR to the 4.8 million homes that sold last year:

The average of the three forecasts is about 5 million sales in 2024 – a small increase from 2023. Lawrence Yun, Chief Economist at NAR, explains why:

“Job gains, steady mortgage rates and the release of inventory from pent-up home sellers will lead to more sales.”

With more inventory available and mortgage rates expected to go down, a few more homes are expected to be sold this year compared to last year. This means more people will be able to move. Let’s work together to make sure you’re one of them.

Bottom Line

If you have any questions or need help navigating the market, reach out.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link